In today’s digital age, people are empowered with access to knowledge like never before. With one exception – most Americans still have no idea what their healthcare visit will cost prior to receiving the bill.

Patients are often left in the dark when it comes to the cost of care and what is deemed a “covered service,” and this inability to effectively research and compare services acts as a major barrier to achieving health literacy and equity.

Not many consumers are asking how much healthcare services cost but among those who do, they are seeking answers primarily from their insurance companies.

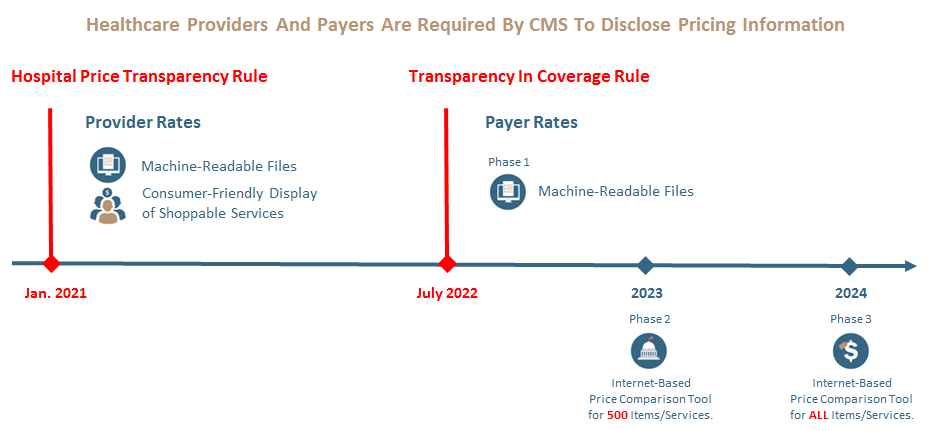

#Healthpayers are required by CMS to disclose #healthcarepricinginformation, including in-network #providers rates for all covered services and items and allowed amounts for out-of-network providers. Payers must also allow consumers to get an estimate of their cost-sharing responsibility for a specific service or item from a specific provider for at least 500 items and services.

Health plan price transparency helps consumers know the cost of a covered item or service before receiving care. Beginning July 1, 2022, most group health plans and issuers of group or individual health insurance began posting pricing information for covered items and services.

About the only thing excluded are the prices paid for prescription drugs, except those administered in hospitals or doctors’ offices.

More requirements will go into effect starting on January 1, 2023, and January 1, 2024, which will provide additional access to pricing information and enhance consumers’ ability to shop for the health care that best meet their needs.

Plans and Issuers

In three stages, most group health plans and issuers of group or individual health insurance are required to disclose pricing information.

In three stages, most group health plans and issuers of group or individual health insurance are required to disclose pricing information.

(1) Machine-Readable Files containing the following sets of costs for items and services

- In-Network Rate File: rates for all covered items and services between the plan or issuer and in-network providers.

- Allowed Amount File: allowed amounts for, and billed charges from, out-of-network providers.

(2) Internet-based price comparison tool (or disclosure on paper, upon request) allowing an individual to receive an estimate of their cost-sharing responsibility for a specific item or service from a specific provider or providers, for 500 items and services.

(3) Internet-based price comparison tool (or disclosure on paper, upon request) allowing an individual to receive an estimate of their cost-sharing responsibility for a specific item or service from a specific provider or providers, for all items and services.

Phase 2 and Phase 3 go into effect in 2023 and 2024.

By plan or policy years beginning on or after January 1, 2023, most group health plans and issuers of group or individual health insurance coverage are required to disclose personalized pricing information for all covered items and service to their participants, beneficiaries, and enrollees through an online consumer tool, or in paper form, upon request. Cost estimates must be provided in real-time based on cost-sharing information that is accurate at the time of the request.

Enforcement

On July 1, 2022, CMS began enforcing applicable price transparency requirements. For plans and issuers that are subject to CMS’s enforcement authority and do not comply, CMS may take several enforcement actions, including: requiring corrective actions and/or imposing a civil money penalty up to $100 per day.

Consumers

For too long, Americans have been in the dark about the cost of their health care until they receive a bill. The Transparency in Coverage requirements will empower consumers to shop and compare costs among various providers before receiving care.

Because consumers have an important role to play in controlling health care costs, consumers must have meaningful information to generate the market forces necessary to achieve lower health care costs and reduce spending.

By January 1, 2023, plans and issuers must make price comparison information available with respect to an initial list of 500 identified items and services. By January 1, 2024, plans and issuers must make price comparison information available with respect to all covered items and services. This information must be made available through an internet-based self-service tool and in paper form, upon request.

Typically, consumers receive an Explanation of Benefits after receiving care, which details the prices charged by the provider, the plan’s contracted or negotiated rates, consumer cost-sharing obligations, and other information. Consumers will have access to this type of information before receiving care and can use it to compare prices and better estimate potential out-of-pocket costs.

The question that remains is how accessible this information will be. The reality is that data published in 2022 will be difficult for providers, employers, and consumers to digest. Additionally, how each state enforces health plan compliance with the data submission requirements will vary across borders, leading to different experiences for consumers based on where they live. #healthpayers #healthcarepricinginformation #providers