The fee schedule, sometimes referred to as the charge master, is arguably the single most important financial tool within the medical practice. Although your standard fees are not necessarily the amount you’ll receive from third-party payers, they are the amounts you should list in the charge field for claims you file, with few exceptions.

In reality, you are running a business. As with any other business, the fees charged reflect the value of services delivered. Your fees should be set with consideration for basic business principles, including expenses, profit, return on investment, competition, marketing, etc.

With the fee schedule as important as it is, and it is, it is unfortunate that so many practice’s create their fee schedule without a clear understanding of the methodologies involved. We have seen a variety of fee schedules over the years, some make sense, some do not.

No doubt the most popular method for practice’s to create a fee schedule is to multiply Medicare by an arbitrary percentage.

RVU Defined

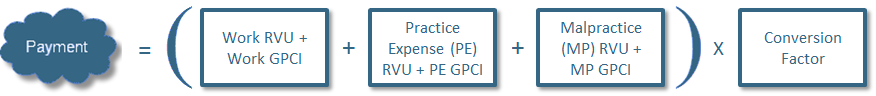

Relative value units (RVUs) are a part of the resource-based relative value scale (RBRVS) and are used in the Medicare reimbursement formula for physician services. Each service in the fee schedule is scored based on the RBRVS to determine payment. Each CPT® code has an RVU assigned to it, which when calculated with the GPCI (geographic adjustment) and conversion factor results in the compensation to the provider for a specific service.

This mind-set and method is easy but it will not steer your practice toward a viable business model. We believe in the doctrine that business decisions must be based on sound market-driven decisions, remember, you’re running a business.

An Analytical Approach to Building A Defensible Fee Schedule

There are numerous perspectives when it comes to creating a fee schedule, benchmarking using RBRVS, cost plus markup, comparative analysis, national averages, etc. We are going to focus on the most accurate, weighted average.

The Weighted Average

A more accurate method is to factor in the frequencies for the codes and therefore give more weight to those procedures that are used more often.

Many payers will show you impressive fee schedule changes that show your average reimbursement as a percentage of local Medicare rates increasing across a broad fee schedule. The problem is that all CPT® codes are not created equal. Revenue contribution must be used as a differentiator.

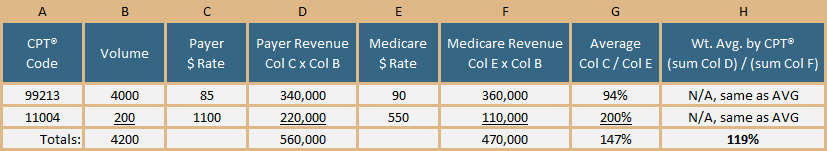

The example above illustrates the importance of using weighted averages. In this example, the average percentage of Medicare for the two codes combined is 147 percent. This is what the payer will tell you and this is accurate. The only problem is your real average reimbursement, or the weighted average, is actually 119 percent.

If this were an actual contract negotiation, we should be negotiating up from this 119 percent, not 147 percent. Further, the payer may be averaging across all CPT® codes in our fee schedule, not just the top revenue producing codes. It is not that the payer is wrong for telling you that the average rate of reimbursement is 147 percent. Rather, it is wrong for you to base your negotiation (or charge) on the average because the average does not account for the revenue impact of each code. It is best to use weighted averages to maximize your reimbursements.

Summary

A primary goal of the medical practice is to be profitable. Failure to follow standard business principles is what often times keeps a medical practice from achieving financial success. It is highly recommended that practices establish a regular schedule for charge master review.

Remember: always work with weighted averages; fully analyze your charge master to be sure that you do not fall victim to the “lesser of” language and that your billed charges are set at high enough UCR thresholds; and work with your most important codes to assess the impact to payer fee schedules.